Charity annual reports and accounts are one of the key unifying features of the charity world.

All but the smallest charities have to produce them. They set out their income, their expenditure, their reserves, their salaries above a certain level and much more. Indeed, the rules governing charity accounts are over 100 pages long.

Except for small charities doing simple cash accounting, the format of accounts is set by the SORP (Statement Of Required Practice), and changes are driven by changes in accounting standards and co-ordinated by a Committee on which I have sat for the last 18 months.

The requirements for charity accounts set by SORP have evolved over many years. In attempts to pin charity finances down more clearly, the requirements have got more detailed. Grant-makers are typically one of the groups who like more detail in charity accounts, so they can do due diligence before making grants.

Listening to debates on the SORP committee, I find that my fellow committee members, who are mostly finance and accounting folk, talk a language that I can barely understand sometimes.

My interest in charity accounts is the window they provide on charities and their activities. Our research at nfpSynergy has consistently shown that the public are as concerned about how charities spend their money as how they raise it.

Around 60% of the public say that a charity spending too little on the cause would put them off giving. Around 50% say that too much spent on staff salaries, or not knowing how their donations were spent, would put them off giving.

The good news is that charity reports and accounts do show all this kind of information. The bad news is that the information is not easy to find either on charity websites or in charity accounts.

Our research, published in our free report ‘Searching for Answers’ in 2014, showed that it’s very difficult to find out things such as how much a charity spends on fundraising, or how many staff are paid over £60k a year except in the accounts.

The problem is that charity accounts are very long to find any specific information in. One of our lucky researchers analysed over 50 annual reports and accounts found that the length was typically 50-60 pages, and while the shortest was a positively skinny 23 pages, the longest was around 177 pages.

An analysis of the research showed that there was no relationship between the length of reports and accounts and the organisational income. Some charities just like to go on a bit.

Accounts are used by a variety of stakeholders, people who they are designed to be for: the Charity Commission, the SORP regulations, trustees, staff, beneficiaries, donors and the public. The conundrum is what to do when these interest conflict. The more detail provided because its’ required by grant-makers, the less likely it is that donors will even to try and find what they are looking for.

My solution to this is to have an executive summary in charity accounts: a key facts section if you like.

This would cover income and expenditure on key areas such as trading and fundraising. It should also cover the number of staff who are paid above £60k, as well as other information such as staff numbers, reserve levels, and this year’s figures compared to previous years.

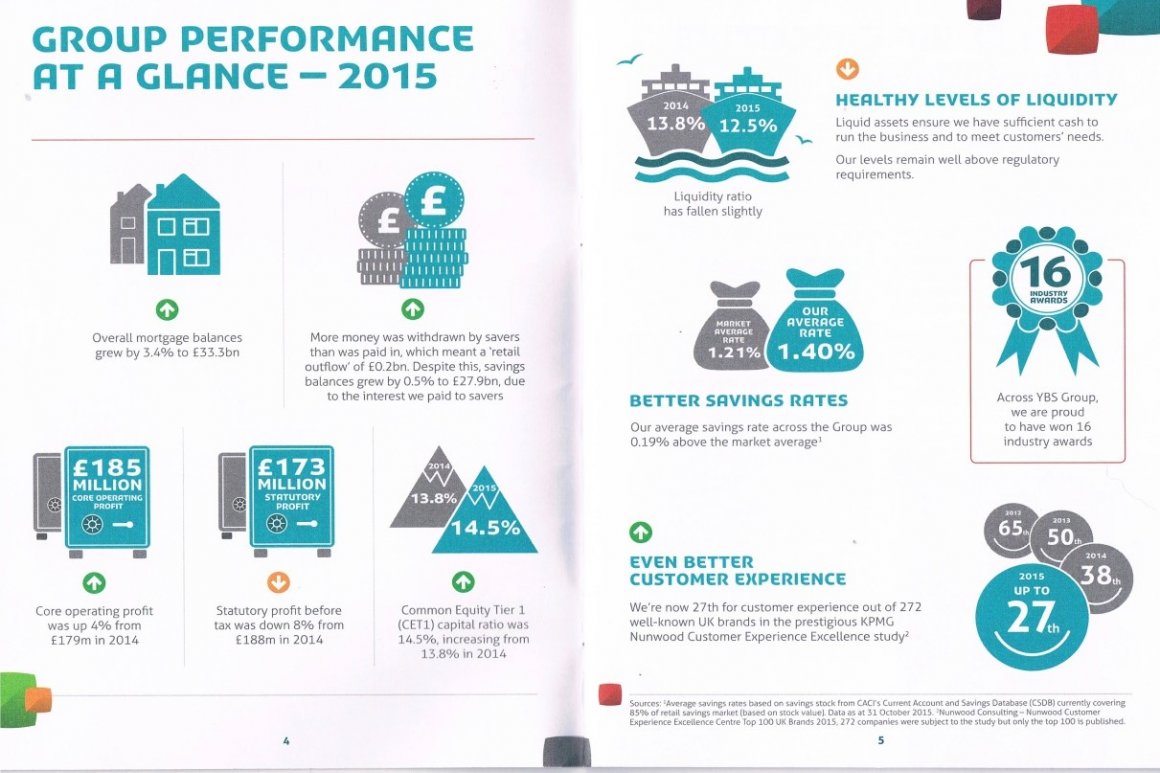

Indeed, what I am suggesting is not a million miles from what is already on the overview of a charity on the Charity Commission for England and Wales website. And I found a good example of a ‘key facts’ section from another sector in the Yorking Building Society annual report.

It covers finances, but it also covers customer service and awards. So while a charity would have certain features that it had to cover, it wouldn’t have to be all about money, and it would have the freedom to cover things it was particularly pleased about.

All the coverage and repercussions that came to light in the wake of the tragic death of Olive Cooke show that public trust is shaken by these kinds of events, and that there is a gap between the public perception and the reality.

The problem is that charities have tended to shy away from being transparent about their finances and salary structures. This disconnect between what charities do and what the public think they do has meant that charities have fallen harder, and public disillusion is even greater when the reality comes out. We need systemic improvements in transparency, and a key facts section required by SORP is one way to do that.

If you want to respond to the consultation its here. The information is on the excellent SORP microsite. The consultation is open until December 2016, and there are many other ideas for how SORP could change. Please respond especially if you agree with me on a ‘key facts’ section in charity accounts. The shape of charity accounts is far too important to be left just to the accountants and grant-makers. They matter to everybody concerned with charities.

I intend to fully read the

I intend to fully read the various links but I thought I would mention the problem I have had with a charity's Accountants and indeed the Charity Commission on providing information on Trustee's who have shares, and/or business relationships with the owners of suppliers. My opinion is all Trustee's connections must be disclosed however this appears not to be the case currently.

It is hard to believe that any business relationship of a Trustee to a supplier is not reportable as a matter of course. There is a grave danger that exemplary charities like the National Trust who report all connections will be assumed by the general public to be the norm and the lack of this information from other charities means there is nothing reportable.

How about including some

How about including some Impact measures in the Key Facts section? Clearly every charity would report on different impacts, which would require adherence to some official guidalines. All key facts should have a prior year comparison.

Key Facts is a good

Key Facts is a good suggestion - attention will need to be given to what needs to be included rather than leave it as a broad suggestion.

Back in 2002 the Strategy Unit Review of Charities "Private Action, Public Benefit" included the recommendation "In general the sector does not produce sufficiently accessible and relevant information to meet the public’s needs. This report proposes higher standards of information provision, including a Standard Information Return in which larger charities will focus on their objectives and measure outcomes against these ....it would focus on impact and would enable comparisons to be made between similar organisations. This information would then be made available in a user-friendly format on the Charity Commission website."

Sadly, this recommendation turned in to the Summary Information Return which did not focus on impact, was not available in user-friendly format and was withdrawn in 2014.

We can and should learn from this, but thought needs to go into what readers require in terms of key information.

Joe - Thanks for what you are

Joe - Thanks for what you are doing on the SORP Committee and for highlighting this consultation and encouraging responses from those who actually use charity accounts.

But I am not persuaded that your suggestion of a "key facts" section would be very helpful - at least not as a compulsory requirement - for three reasons:

(a) Of necessity it would mean duplicating info that is already provided elsehwere in the Trustees Report+Accounts and hence making the documents longer still. Not many charities would have the resources to put together infographics like the example you show above: most would just cut and paste text so that certain info would appear twice.

(b) Different people regard different info as "key facts". You suggest that staff paid over £60K is key but your Yorkshire Building Soc does NOT include the director's remuneration info which is one of the most contentious elements in Building Soc accounts. However, I agree with Patrick Taylor above that transactions with trustees and connected persons is extremely important - Patrick this IS already compuslory in SORP accounts, and even there were no such transactions this must be stated. But I don't think that what is somethimes a detailed list of related party issues can easily be covered in a "key facts" section. Indeed, in my experience, one of the reasons charities sometime produce summarise accounts is specifically in the hope that people don't ask for the full accounts which contain these disclosures.

(c) In my experience some people will never look at accounts no matter what one does not make the info clear and understandable. But for those who are willing to look I don't think it takes much time to find specific material that one wants.

Some larger charity do already provide these sort of key facts in the Trustees Report, often with pie charts or similar graphics, and that is fine if it's optional, but I think there is little to be gained from making it compuslory.

The bigger issue in my view the vast numbers of very poor reports+accounts that are still produced, often not even showing any date when they signed off by the trustees or auditor/ind examiner (so possibly just a draft prepared by one person) yet it is very rare for them to face any sanctions due to limited Charity Commission resources.

"However, I agree with

"However, I agree with Patrick Taylor above that transactions with trustees and connected persons is extremely important - Patrick this IS already compuslory in SORP accounts, and even there were no such transactions this must be stated"

Gareth. I am afraid that this is not true. I also believed it to be true but I have been involved with the Charity Commission and the ICAEW over the past year regarding a famous name charity where the Chairman's holding in a supplier was deemed to be below a reportable level. Personally I think any contract should be reported unless it falls below a certain amount or percentage of a charities income for example £500. The case I am pursuing was one for over £0.5m a year, and is now in its 8th year.

Thankfully my M.P. also felt it rather untoward and has asked the Charity Commission to reconsider its refusal to act in 2015. The ICAEW are also considering the matter as it impinges on their guidance to auditors, and perhaps more importantly on what one set of auditors pass on to another.

You would be amazed at the replies I have received why it was not reportable and primarily it revolves around only having a 1% per cent of shares. The illogic of 20% of £500 being reportable but 1% of £0.5m not being seems to elude the professionals.

i could be more technical but essentially Trustees and full disclosure IS NOT happening in this charity and I suspect oothers if they follow current guidance.

I have posted in two parts,

I have posted in two parts, the first dealing with a Trustee ,a £0.5m contract currently unreported over four of the last six years [ I add this because I am having technical problems and I think I gave an incorrect figure.

This post is what I think would be advantageous for the public to gain from Key Facts.

Gina Miller's the Hornets Nest got hammered but this week I have been stunned to see how her blunt methodology would have highlighted charities like Hospice Aid UK where only 5% goes to the cause and 90% to the employed fund raising company.

I maintain that the charity sector is confusing and that charities need to be identifiable for what sort they are, and then the pertinent facts can be relevant to them. It is no good trying to compare Motability with Hospice Aid UK, or the Albert Hall. Fundamentally the sector needs categorisation. If this means that their cleverly constructed trade name need s to always include and R or an E or a D to show the public what they are about so be it.

Good idea (one of many Joe!)

Good idea (one of many Joe!)

1)I like the idea of a Key Facts, but suggest that it should be consistent for all charities, so comparing like for like. The current accounts follow SORP, but figures for costs are not shown in a transparent or consistent manner.

2)If more charities realised that many donors would prefer a short sharp summary and actually read this, then I am sure they can find the time to reduce those big sets of Annual Reports/Accounts and invest in this area.

3)I too have been look at various accounts for many charities and I think we have only seen the tip of the iceberg. There are many examples where charities are spending up to half of their voluntary income on fundraising costs each year for several years. Trustees need to explain why. Charity commission is only concerned with receiving the accounts, not looking at them for any issues.

So overall, welcome the idea and debate, but also would like to suggest consistency and like for like comparison (not an easy task), or the sector continues to have similar issues in future.

Stop assuming a level playing

Stop assuming a level playing field.

Whilst I agree with much of what is written, especially the need for charities to be transparent and open in their finances the difference in a small organisation turning over £90K and an organisation turning over £900K is immense. For the smaller organisation the reporting and accounting is an increasing burden, especially as the process changes and there are multiple SORPs. Many of the Charity Commissions templates that worked really well for small organisations are no longer valid and I have not been able to find new versions based on the new SORPs.

There will always be an element of comparing apples to pears when looking at different charities accounts (just as there is in the commercial world), for me what is important is that the reporting requirements are proportionate and reflect all the charities they are designed for. Many charities produce both the annual report and accounts to meet the statutory needs but also produce an annual review (or similarly titled document) that gives a more comprehensive view of the work of the charity and the impact it makes. These reviews are much more readable (and in my eyes informative) than the annual accounts and report. These range from the long and glossy https://issuu.com/cardboardcitz/docs/ccar_pdf?e=0/7633792, the useful http://www.ngomedia.org.uk/NacroCalendar08.pdf to the short and sweet http://www.cambridgecvs.org.uk/about-us/Annual%20Review Innovative design and the use of online tools and social media have increased the reach that organisations have and a review that can have multiple uses and be shared in a number of ways keeps on giving.

I say let’s keep the statutory regulations to a minimum and encourage groups to share their work in innovative informative and engaging ways.

PS And let’s continue to fight the myth that expenditure on staff is not also expenditure on the mission of the organisation. Stuff does not happen by magic, it needs people!

Great to see all the

Great to see all the different comments. Thank you.

In no particular order here are my responses.

1. Any key facts section would have to be facts, not narrative. The old SIR was pointless because it narrative, and just became an extended part of the annual report and every charity treated it differently. The core ‘facts’ would need to be specified (and that requires more work) but of course charities should be able to add some of their own.

2. The extra work required for ‘key facts’ for larger charities is minimal. Its data that is already in their accounts. How people format it is up to them. A large portion of the ‘key facts’ data is already directly input by charities to appear in England and Wales in the Charity Commission overview. That summary is useful, but not enough alone. This is partly because of geography – it excludes Scottish, Northern Irish and charities from the Republic. It’s also a problem because if you look for Mencap over 400 charities come up on the Commission website, and over 100 for Red Cross. It’s also daft that it’s easier to find data on a different site from the charity’s own.

3. The comments highlight the dilemma SORP guidance faces. Some stakeholders want more and more data (trustee interests, etc) but the public/donors just want the highlights. And are only really interested in knowing they are easy to find, to reassure, should they need them.

4. Is data hard to find as it stands? Its one of the issues I hope we can find out in the focus groups mentioned below. And Gareth is right that the Yorkshire Building Society key facts doesn’t mention CEO salary (though it does in the main accounts). However I suggest that far more people care about a CEO salary in their choice of which charity they give to, then the salary of the CEO from the organisation who they get a mortgage from. So each sector will be different.

5. If the proposal for ‘key facts’ is agreed it will need to be spelt out which facts are to be included, for what size of charity and so on. We have some focus groups in the autumn where I hope we can explore these issues with donors a bit more. We are also planning to create a twitter account for SORP as the four jurisdictions nature of the guidance makes that hard. So it will be an unofficial sort of fanzine for SORP