Between February 2011 and February 2013, we had a PAYE audit at nfpSynergy. If I live to be 100, I think it will still rank as one of the most painful, expensive, exasperating and protracted audits I experience. When we began the process, I could find virtually nothing in writing that prepared us for the compliance check that was randomly foisted on us by HMRC. Writing this is my attempt to help others be better prepared than we were.

What is a PAYE audit?

A PAYE audit is a check by HMRC to establish whether a company is paying all the income tax and national insurance (employers and employees) that it should be, on both its payroll and its outgoings. It might seem like this is a relatively straightforward issue; simply, whether somebody is on the payroll or not. Here are five myths that I had shattered during the course of the audit:

- Myth 1 – directors or shareholders can borrow money from their companies and don’t need to pay tax on it

- Myth 2 – provided freelancers are working for other clients too, they don’t need to be on your payroll

- Myth 3 – our justice system says people are innocent until proven guilty

- Myth 4 – a company can decide who is a home worker and who isn’t

- Myth 5 – the tax system is both fair and simple

In order to carry out a PAYE audit, the HMRC pick a financial year and then take away every financial record they can lay their hands relating to that year. They then come back and ask you a zillion questions about it. Then, they decide how much you owe them for that year and extrapolate backwards and forwards in terms of years and multiply the sins of the year in scrutiny by the number of years you did the bad behaviour for.

Our audit in quotes

The tax lawyer: ‘You need to remember Joe that HMRC make the rules and they judge the rules, so what they say usually goes.’

The accountant:’ You need to remember two things: tax isn’t fair and it isn’t simple’

The HMRC auditor: ‘What are you doing about ransom payments?’

Our office manager: ‘Has anybody seen the credit card receipts for 2009/10? I can’t find them anywhere.’

Me: ‘It was a terrible business decision. We wasted lots of money on it. But that doesn’t mean it was salary for me.’

The areas we had scrutinised

Director’s loans

I have often heard self-employed people and small businesses tell me that directors’ loans are a great wheeze for getting income and paying less tax. If they achieve this, then they are lucky. HMRC can force you to pay them or your company an interest rate that they set and to the point that taking a loan has no financial benefits at all – quite the opposite. I took a director’s loan because as a business we had seasonal cash flow and the interest rate we could get was pants without locking it up for years. So, moving the cash to use on reducing the balance on my offset mortgage seemed like a great idea. My accountant had already told me the interest charges were high. In the end, the best solution was to pay the company interest not HMRC – but even so, I paid an interest rate of 6/7% to offset my mortgage rate of 1 or 2%. Not clever really.

We were stupid about interns

Back in 2009, we started using interns on short-term contracts. Rather than put them on the payroll for 3 or 6 months with all the hassle that involves, we got them to give us an invoice each month and told them to pay their own tax. We also had a consultant who we used irregularly and who billed us for the days she worked for the bursts of work she did. She had another client at the same time, but it made no difference. We were charged for the employer and employee national insurance (NI) and for missing income tax where appropriate (indeed for the consultant we were charged £2,000 of income tax for the consultant until we asked her and she said she had already paid the relevant income tax). We had one intern who was with us for only 6 weeks. She missed the payroll run for one month and had handed in her notice by the end of the next. We had the email trail saying she needed to go on the payroll (having learnt the error of our ways long before HMRC came along). Our biggest single payment of back tax, fines and interest was for the interns.

Home-based working

I live in the Lake District and the office is in London. I come down each week to see clients, catch up with colleagues, carry out my duties as a trustee or to do presentations and talks. I spend more time working at home than I am in London (where I don’t have a desk). HMRC believed that my place of work is London, so all the expenses I had claimed for coming to London were really a benefit and so should be treated as salary. To make life more complicated, nfpSynergy has always paid my expenses as a trustee and for presentations. We have board minutes showing that my place of work was agreed to be my home. Apparently, HMRC can decide where my place of work is and that doesn’t need to bear any relation to where I actually work.

To support their argument, HMRC cited case studies from 1897 (sic), 1925 (sic) and 2002. We are in an age of home-working, where the government and companies are pushing for better internet so people can work from home and be home-based. Yet the tax treatment is based on case law from before the motor car, the radio or the telephone was in widespread use, let alone the internet. This feeling of HMRC not keeping up with the real world was compounded by the fact that HMRC don’t use email for any communications. Everything is posted, usually adding around two weeks to any communication.

Whose taxi is it anyway?

One niggling source of dispute was taxis. Like many people, I suspect I am not good at documenting which clients or journeys a taxi receipt was for. HMRC was clear on their position on all receipts for expenses; ‘without such supporting documents or reasonable records, the payment made may be considered as a taxable benefit for the employee concerned’. So where I hadn’t written on a taxi receipt what it was for, HMRC was able to consider it as a taxable benefit. Given that I am the one who writes on my own taxi receipts, I remain puzzled why me writing, ‘xyz charity on abc date’ on a taxi receipt is any kind of evidence for HMRC. For me, this is a perfect example of how I have to prove that my expenses are legitimate, or HMRC can presume they are taxable benefits. I am guilty unless I can show I am innocent. We eventually settled on an allocation of taxi receipts as taxable benefits.

Let them eat Cake – unless it’s really their salary

Food and refreshments turned out to a very complicated issue from a tax point of view. HMRC doesn’t mind basic office supplies being treated as a legitimate expense. What about cake? Our office eats a lot of cake on Fridays. Is that a taxable benefit or a legitimate business expense? If the cake were eaten at a local café, it would definitely be a taxable benefit, unless we could show that it was members of staff having a conversation which there was no space to have in the office. What about lunch? Like a team-building meal with staff? I must confess that, despite the audit, I am still not very clear about which expenses are legitimate and which are not. I am sure our office manager is though!

Man Utd season tickets

We had the opportunity to pay for a couple of Man Utd season tickets. We thought it would be great for client entertainment, not least with 2 Man Utd fans as directors at the time. It was anything but a good idea. Most weeks the seats would be empty and our money wasted. HMRC wanted us to show who had entertained which clients and when, but we hadn’t kept a record of any of that. Our auditor didn’t pursue this one thankfully, but we just hadn’t kept the records to show how little they were used.

Roundsum payments

So our auditor didn’t actually ask about ransom payments, but roundsum payments. We just misheard. A roundsum payment is one where a general amount of money is paid as an expense, rather than the hassle of receipts and all that. And we were guilty of using roundsum payments. We paid our staff £5 a month so that we could be sure that they had a mobile for work, without having to make them go through every line of their monthly bill. A roundsum payment is not a legitimate expense, so now we pay our staff nothing for having a mobile unless they want to provide evidence for each and every call they make for our business.

Keeping track of cash

As a business, we had two types of cash - petty cash and cash for the incentives for our focus group work. We were way too sloppy about documenting our use of petty cash (all that Friday cake and other legitimate expenses). We weren’t great about documenting our use of cash for incentives either. HMRC was very suspicious about our poor record-keeping of incentives cash and not that impressed with our petty cash record keeping either. If I’m honest, I wasn’t impressed when it became clear how bad we were. However, incompetence in record-keeping doesn’t automatically mean that anybody was taking the cash as a taxable benefit. The difficulty is that we had to prove that we weren’t by documenting what we were doing with it. You can rest assured that our record keeping on cash is a lot better now.

It could have been worse

We escaped a number of areas that often fall within the remit of a PAYE audit: use of cars and vans, private use of fuel for those vehicles, dividend payments versus salaries for directors and shareholders, pension arrangements and many more. In addition, our auditor was a human being who would listen and respond to our arguments and documentation. So if we could make the case and show how or why we did what we did, they would listen.

The silver lining

The audit has made us sharpen us our record-keeping and financial diligence. We have changed our accounting software to a brilliant package called Xero, so we can make sure that every payment is correctly coded and all payments are reconciled. We have a file of receipts for credit cards and petty cash for each month now. We have a petty cash account as part of Xero, which makes sure we keep tabs of all cash going in and out. We’ve also refilled and relabelled all our financial records.

We are better at our financial record-keeping than ever before and we are systematically clearing out every cupboard and dumping ground in the office to look for missing or misplaced files.

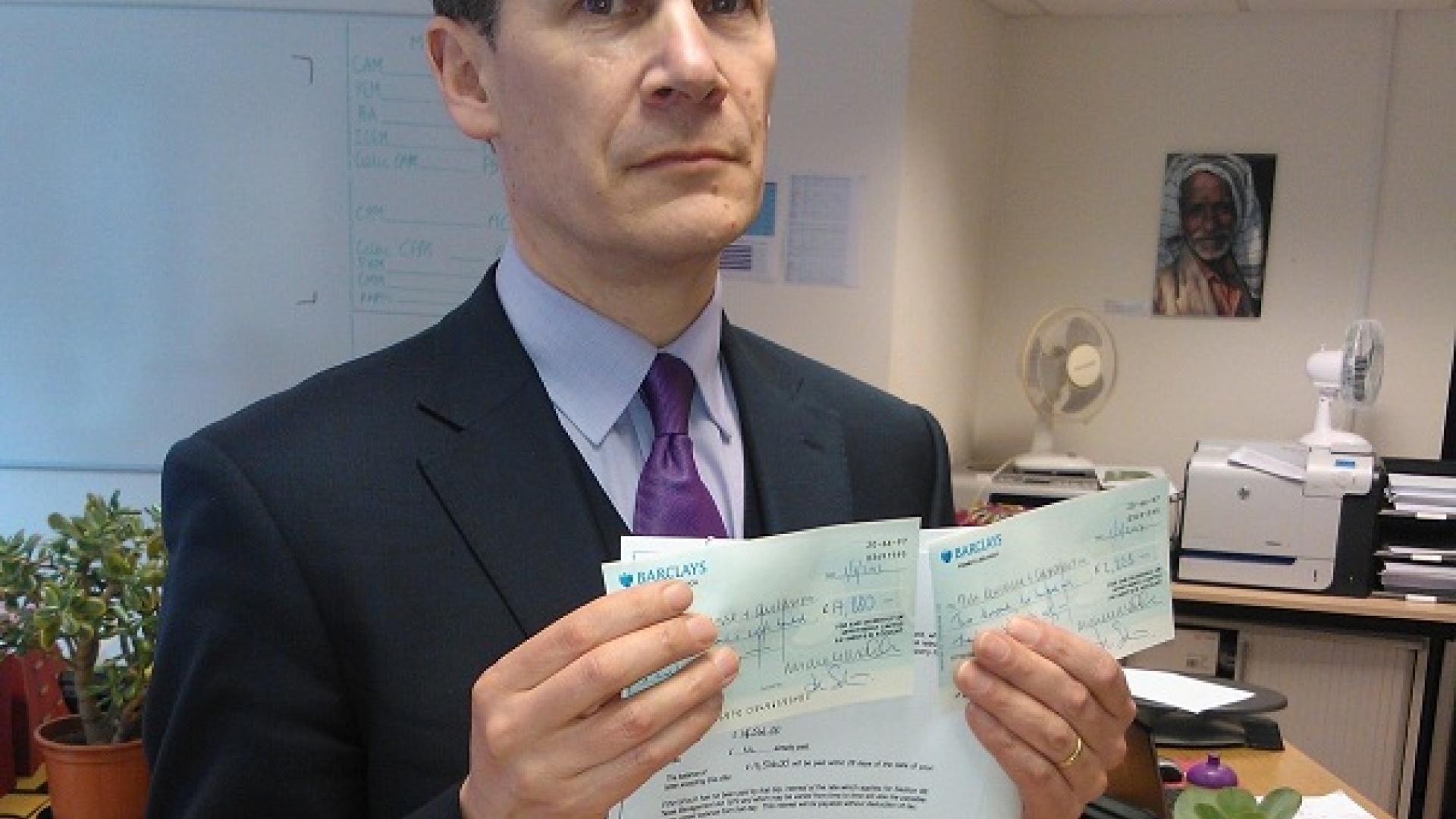

The cost to us as a company

At the beginning of March, we paid HMRC just under £20,000. That’s about £14,000 of payments in national insurance and income tax, £3000 of interest and £3000 in fines. I personally paid back £13,000 to the company for travel expenses that were deemed to be income. We paid our accountant another £3000 for all the extra time they spent on the audit. We spent about another £3000 in getting interns to go through all the paperwork to look for the requested bits of paper. That doesn’t account for all the time me and my colleagues spent on the audit. But let’s say it comes to £39,000 in out-of-pocket costs to us and another £15-£25,000 in directors’ and staff time at a cost of £300-500 a day. So, over £50-£60,000 in total. Please spend it well Mr Osborne.

In conclusion: how could things change?

So far, so unhappy. We had an audit. We were found wanting. So surely, HMRC are well within their rights for hunting us down like any other tax evaders? Up to a point, the answer must be yes. A government needs the revenue, so it must take the relevant action to find people like us. Is any anger I feel just sour grapes?

I think there are three key factors in deciding whether this kind of audit is a fair approach to maximising tax revenue.

1. Are tax laws simple enough for small businesses to understand? The simple answer is no, they aren’t. As a business, we couldn’t have dealt with the audit at all without our accountants (we have now joined the Federation of Small Businesses (FSB) as alternative insurance against future audits). However, the tax laws are so complicated and so mercurial that it’s an uneven battle; small companies trying to earn a living vs. HMRC experts who do this every day. It feels like shooting fish in a barrel and we were the fish.

2. Are companies of all sizes treated equally? We’re going to try to do a freedom of information request to find out how much money is reclaimed from the SME sector and how much is reclaimed from the large corporations who are so good at evading corporation tax. We would guess that more is invested in and more is reclaimed from small companies than large ones. Big companies have built in advantages too. If a company is large enough to run its own in-house gym, it’s not a taxable benefit, but if we paid for our staff to have an external gym membership, it would be taxable. The same is true for great cakes from an in-house canteen vs. great cakes from the local shop.

3. Is this the way to encourage entrepreneurship and enterprise? Two years is a long time to have the gnawing distraction of a PAYE audit. It doesn’t help us focus on our business. It became a kind of war of attrition; would our stamina to fight what we saw as an injustice last longer than our desire to get back to our real work. One thing is for sure, PAYE audits are a good way to distract small businesses from their core business. I can only hope the additional revenue for HMRC is worth it.

I wouldn’t wish a PAYE audit on any business. It’s much better to be organised in advance than to try and play catch up once an audit is called. It’s vital to have a good accountant and/or join the FSB in the event of an audit into your business.

Got an opinion on our story? Leave us a comment below.

At Target, we had a surprise

At Target, we had a surprise audit, we'd been chosen at random apparently. Luckily I'd been tipped off so, in the initial meeting I had my ex-Inland Revenue consultant advising me. I was asked in words designed to freeze the heart, whether I personally endorsed the accounts they were auditing (accounts from four years previously). I had signed them of course!

I confirmed my absolute trust in said accounts. "Then perhaps you could let me have your personal bank statements" ...for a five year period surround the year in question. I went white, I had nothing to hide at all, we couldn't even afford central heating in the wreck of a house we were living in at the time. But I wasn't even sure I'd be able to find five years of bank statements! Luckily my smooth consultant challenged her - actually she had no right to ask without a prima facie belief in my guilt. But the sheer belligerence was astounding.

Three years later, after similar agony, they asked us for unpaid tax of LESS than £2,000. What a waste of time and effort!

Joe,

Joe,

Thank you for being brave and sharing your agony. Also pleased that the costs paid out doesn't seem to have pushed your business out of business when presumably the Government would get even less Tax.

Please keep us posted on your Freedom of Information request as it will be interesting to see the reply - whether you will glean much from what is says will be another matter!

Some research we conducted

Some research we conducted for the IF campaign recently revealed that 41% of people feel tax avoidance is a major problem facing the UK.

But fear not, only 19% of people intend to sign a petition, write to their MP or otherwise raise their voices about tax avoidance by companies in UK, (13% for individuals) - which might be less than the proportion of your clients: http://enoughfoodif.org/who-we-are

We had a lot of trouble with

We had a lot of trouble with the previous SEO company, I have been reading up on it myself and next time I

are probably going to employ a junior to do it

Bookmarked your blog, should help me keep up to date with your posts

Thanks for sharing this with

Thanks for sharing this with the outside world Joe, your comments are refreshingly honest. Unfortunately, your experience is not uncommon, I am an employment tax consultant and I see employers suffering like this week in and week out. There is two sides of the coin to this however: Firstly, HMRC is often the cause of much of the heartache, needlessly, by a) chasing minor issues when their focus is supposed to be on the bigger picture around tax risk management, b) by their officers often being too inexperienced resulting in lots of time wasted asking irrelevant questions and reviewing non-issues and c) not being commercially minded enough to understand WHY payments have been made, regardless of the tax rules. However, the flip side is that many employers, and I guess NPFSynergy is included in this going on your experience, are a) too naive about PAYE tax rules, b) too reluctant to invest in "proper" employment tax advice until it is too late and c) often too quick to cave in to HMRC's demands or assertions - please note HMRC is not always right, in fact HMRC is often wrong !! If only you had come to someone like myself before HMRC came in, or even during the audit, you could have saved yourself a lot of time, effort and hard cash. Some of the issues you mention above would have been non starters if I had been there ! Easy to say in hindsight I know. Best of luck anyway in avoiding similar heartache in a few years time. Regards Brian Rudkin, Optimum PAYE (www.optimumpaye.co.uk)

Thanks Joe, great article,

Thanks Joe, great article, thanks for sharing; I too would be very interested to see if you get anywhere with your FOI request. My business (30 employees) is currently undergoing and investigation. We thought we were squeeky clean; however they have really gone to town on the detail (to the point of querying a £34 bill to our window cleaner, and had we performed due diligence and check he was registered for tax!); Our main problem is Home working; we have 30 employees and only 15 desks, so a number of employees work from home or client site. We allow home based workers to claim mileage to travel into the office for meetings; this is now the area of dispute; what constitues a temporary workplace?

On this home working front they have refered me to the 78 page (booklet 409); this is not straightforward at all.

So I'm frustrated, even more so as I have just finished reading the excellent "treasure Islands, tax havens and the men who stole the world"...the story of major corporate tax avoidance.

So now I feel as if I have been pulled over by the police for doing 32mph in a 30 zone. Meanwhile, Mr Large Corporate speeds past us at 100mph in his Ferrari with a big grin on his face.